Property Prices Rise 0.6 Per Cent In Last Month

[ad_1]

House prices across the region noticed another increase in worth previous thirty day period, having said that, the fee of enhance carries on to gradual down.

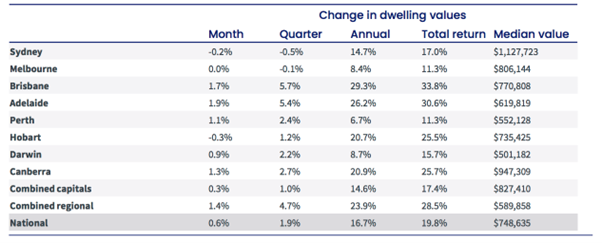

In accordance to the most recent data from CoreLogic, house selling prices increased .6 for each cent in April, led after yet again by the lesser cash city marketplaces.

Adelaide was the ideal-performed funds town in April, observing values enhance by 1.9 per cent, adopted by Brisbane at 1.7 per cent and Hobart with a 1.3 for each cent maximize.

Residence values in Sydney and Melbourne keep on to gradual down after an incredible 18 months of advancement. Sydney property charges fell -.2 per cent, Melbourne remained flat when Hobart has also posted a slight tumble of -.3 per cent.

More than the previous 12 months, residence costs are now 16.7 per cent increased, with regional areas outperforming, up 23.9 for every cent.

Source: CoreLogic

CoreLogic’s Research Director Tim Lawless stated soaring desire charges have started out to place force on homebuyers which is translating to sluggish price tag advancement.

“With RBA dollars level established to rise, we are probable to see a even further loss of momentum in housing conditions more than the remainder of the calendar year into 2023.” Mr Lawless claimed.

“Stretched housing affordability, greater mounted expression home loan charges, a increase in listing quantities across some towns and decrease shopper sentiment have been weighing on housing conditions over the past calendar year. As the hard cash level rises, variable home finance loan premiums will also craze greater, minimizing borrowing ability and impacting borrower serviceability assessments.”

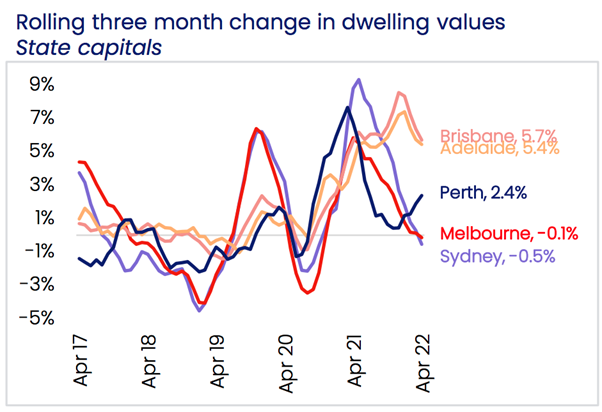

The Sydney and Melbourne markets have been the most important two metropolitan areas to see slowing price tag development and had moved into destructive territory on a quarterly basis for the initially time considering the fact that the 2020 lockdowns.

Mr Lawless claimed that when the more compact towns are presently even now going through price tag appreciation, they as well will possible see slowing development in charges as higher desire fees get their toll.

Source: CoreLogic

Listings Stay Reduced

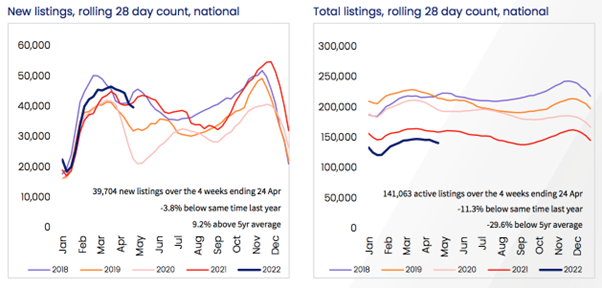

Whilst selling price advancement has weakened, one particular of the regular themes about the earlier few several years that has aided thrust rates bigger has been the absence of accessible stock on the market place.

According to CoreLogic, advertised inventory, at a national stage, is tracking just about 30 per cent beneath the prior five-calendar year typical. Whole advertised stock is far more than 20 for every cent below concentrations from a year ago in Brisbane and Adelaide, and close to 40 for every cent lower than the past five-12 months regular in both cities.

In weaker markets like Melbourne and Sydney, advertised offer degrees have normalised. Sydney marketed stock ranges are approximately in line with the earlier five-12 months normal, whilst listings in Melbourne were being 8.2 per cent better. Greater inventory levels across these marketplaces can be defined by an earlier mentioned average move of new listings coming on the sector in mixture with a drop in purchaser desire.

In Hobart, where by April’s -.3 for every cent decrease follows 22 consecutive months of growth, stock stages started off to increase in the center of March.

The new listing count is now 46 for every cent bigger over the four weeks to April 24 when compared to the very same period of time in 2021.

“With greater stock degrees and much less competitors, buyers are progressively moving back into the driver’s seat. That means much more time to deliberate on their buy decisions and negotiate on rate,” Mr Lawless said.

Supply: CoreLogic

Tight Rental Marketplaces

Another important function of the previous several decades has been a lack of rental stock and growing rental charges.

Just like overall property marketplaces, rental markets are also seeing varying situations in accordance to CoreLogic. Nationally, rents had been up 2.7 per cent around the a few months to April, having the annual adjust in rents to 9. per cent. A calendar year back, the once-a-year change in national rents was 4.9 per cent.

Dwelling rents (+9.1 for each cent) are increasing speedier than unit rents (+8.7 per cent). However, this craze is altering sharply as need for device rentals raises due to the larger charge of renting homes.

“On a rolling quarterly foundation, we are now seeing unit rents mounting more rapidly than household rents, specially in Sydney and Melbourne the place rental circumstances across the unit sector have been earlier significantly softer.”

“The change in rental demand from customers toward models demonstrates both the rental affordability pressures, which are deflecting far more demand from customers in direction of the ‘cheaper’ device sector, and the return of overseas migrants and guests… Rental demand from customers from overseas arrivals tends to skew to interior town and significant density precincts.”

Market place Outlook

Home charges on a national amount go on to relieve with the peak place in position in March 2021 according to CoreLogic.

Rates have begun to gradual down in line with increasing fixed-amount home loans and with decreased levels of affordability.

With the income price set to go through a fast tightening cycle, CoreLogic expects the softening in the advancement price will grow to be far more pronounced around the coming months right before the national index starts to trend decreased.

“Despite the fact that we are anticipating the housing current market to transfer into a downturn through the second 50 percent of the year, it is critical to don’t forget the context of the the latest progress section,” Mr Lawless stated.

“Since the onset of the pandemic, national housing values have amplified by 26.2 for each cent, including roughly $155,380 to the median benefit of an Australian dwelling.”

The RBA mentioned a 2-percentage position rise in interest could decreased housing costs by 15 for every cent, which would just take residence prices again to a identical level to wherever they were being in April 2021.

CoreLogic believes the extent of any housing market place downturn relies upon on how higher and how fast the RBA raises desire prices.

[ad_2]

Supply hyperlink